Income tax Thing #dos – The latest Dependence Deduction

Regardless if have a tendency to hotly contested during the courtroom, this problem is normally resolved with ease in mediation. Once more, by applying the income tax considered application, I can manage additional circumstances, both which have possibly spouse using deduction(s), or breaking this new deduction(s). The brand new account will show where in fact the best taxation savings lie. When possible, I would like both spouses to discover a tax discounts regarding claiming the youngsters. In addition would not want that it deduction to effect a result of good squandered tax benefit to anyone.

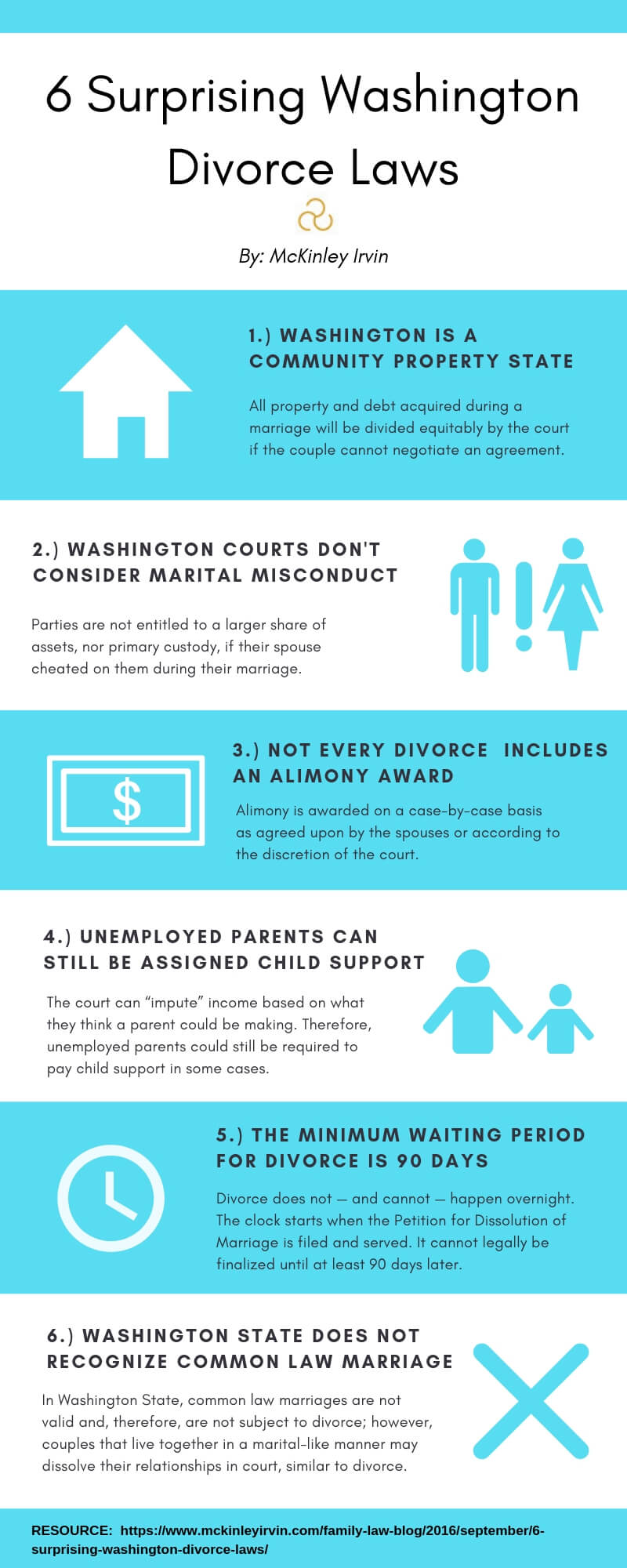

For folks who and your partner generally speaking located a tax get back owed towards advantages of processing as the “Partnered Filing As you,” you may also consider delaying the official divorce or separation decree until after you document fees one last time

- For people who and your mate have a tendency to each other discovered an income tax work for from claiming one or more college students (and tend to be maybe not eliminated of one’s child income tax borrowing because of higher money), it’s also possible to decide to split up the youngsters.

- If you have an odd level of people, you might consider busting each child and then alternative the remainder child each year.

- In the case of one youngster, you may want to option the baby each year, for folks who both be prepared to qualify for a baby income tax credit ongoing.

A wife that have no. 1 child custody of college students was called of the laws in order to claim all of the children in his/her infant custody. But not, there are times which i find this deduction getting squandered into the primary custodian if they have almost no money ensuing in just about any taxation accountability. The reoccurring motif here’s: what’s the enough time-label work with?

For many who and your partner normally discover a tax return due toward benefits of filing given that “Married Submitting Jointly,” you may imagine slowing down the state divorce case decree until once you document taxation one last time

- While the main custodian, you could potentially discuss with your mate to help you surrender the fresh new state they them if they usually understand a taxation work for. More funds on the wife or husband’s wallet setting more funds accessible to shell out child help.

- Additionally, For people who have a much nonexempt income (i.age., payroll otherwise company income) post-breakup you might need the new dependency claim to offset the taxation due in your nonexempt income.

Once again, a switch taxation aspect so you can a split up, however, something very partners overlook. To be able to need this type of write-offs to the relationship house is certain in marriage. But not, upon new separation, what happens to them? The answer hinges on what happens with the relationship family. Whom assumes the brand new marital household on the payment, or perhaps is our home for sale?

Constantly, if a person spouse expenditures another out of the marital family, they’ll supply the advantage of remaining these taxation shelters shifting. This really is a benefit that almost every other spouse may clean out upon quitting your house, once they are unable to afford to get a different sort of household. Typically, new spouse inside status often discuss other areas of the brand new payment in order to be the cause of the loss of this benefit.

If you choose to promote the brand new relationship domestic, there are some tax products to look at dependent on the circumstances leading up to brand new product sales.

For folks who plus partner typically discovered a tax come back owed toward benefits associated with processing while the “Hitched Submitting As one,” you may envision slowing down the state separation and divorce paydayloanalabama.com/leesburg/ decree up until after you document taxes one last time

- If an individual mate was surviving in your house pending their product sales which can be accountable for make payment on financial attention and you may taxes, it seems really fair which they do take all of your own these deductions on the return.

- If the spouses remain living together home pending the newest finalization of your divorce and are discussing most of the interim expenditures, they will often invest in separated just as most of the mortgage desire and fees paid-up up until the day this 1 companion permanently moves in the house. For that reason the most important thing within these points to ascertain a specific “get-out” day on separation and divorce arrangement.