Are you contemplating to get property when you look at the Boise, ID within the 2024 otherwise beyond? If that’s the case, you’ll want to consider various home loan products which are available to make it easier to fund so it large financial support, and acquire the best home loan within the Boise so you can properly finish the purchase.

Handling just the right mortgage lender could make the process because the seamless that one can. After you eventually are quite ready to purchase property for the Boise, ID, we should ensure you are dealing with a sound home loan company when you really need them really. Here’s specific understanding of surviving in Boise, the overall temperatures of Boise real estate market and several tips on how to definitely select the right financial organization to utilize.

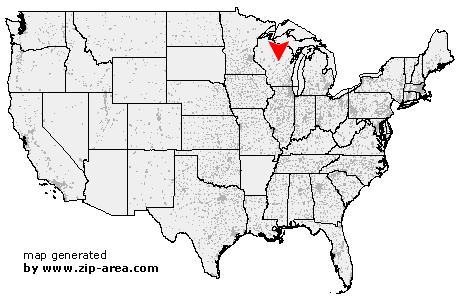

Boise ‘s the resource of state regarding Idaho that’s a gorgeous city, with bountiful greenspace that suit the new outdoorsy method of simply well. The town are dotted that have parks and tracks, particularly in new Boise Lake Greenbelt discovered over the side of the water.

The town is additionally noted for its architectural records, such as the Boise Ways Museum, Idaho Condition Capitol Strengthening, and Dated Idaho Penitentiary. Boise try positioned become the latest housing market throughout the nation in 2010, so if you’re looking to buy a property contained in this area anytime soon, you can discover certain competition from other prospective homebuyers.

Article on brand new Boise, ID Housing market

As of , the fresh new average home well worth inside Boise is about $459,653. That is significantly more than the new average family speed statewide of $432 cash advance usa Thornton address,307. Considering every advantages out-of residing Boise, this family rate may still become in your diversity! Home prices have actually diminished 1% within the Boise for the past 1 year, but they might be anticipated to go up along side second few months.

The market is regarded as aggressive at this time which is anticipated to remain along side brief-name. Therefore, to get during the Boise at some point are your very best choice so you can ride the fresh trend out-of fast really love and give a wide berth to paying high costs.

It’s not only beneficial to be aware of the mediocre price of house from inside the Boise, however it is and helpful to score a concept of exactly how much from a deposit you will have to put together. Considering the worth of the common domestic during the Boise, you are looking at a deposit of approximately $45,965, according to the mediocre down payment amount of 10%.

That isn’t just small amounts, however the advance payment number that you will be needed to lay forth will additionally confidence the loan team inside Boise one you decide on. That is one of the most significant good reason why deciding on the best providers is essential.

Partnering That have an effective Boise Mortgage lender

You need a knowledgeable Boise mortgage lender, and wanted an informed customers. Research your facts to make sure you happen to be a good fit, and work at your bank account and also make oneself an attractive debtor.

Tip #1: Change your Credit rating

One of the first things want to do due to the fact a great homebuyer is always to make sure that your credit score is in an effective status. A top credit history will enable you a better chance of bringing accepted for a mortgage on a lesser rate of interest. Mortgage brokers will at your credit rating when deciding whether or otherwise not so you’re able to agree your. They’ll additionally use they to select the types of price to help you offer you.

If for example the credit score is found on the lower front, think providing sometime to change they. Generally speaking, a credit score of ranging from 650 and you can 680 is regarded as the lowest that every loan providers will require, although each lender will get their minimum credit history requirements. For folks who give your credit rating an increase, you could potentially discover a great deal more doors yourself.