Backed by the fresh U.S. Service out-of Farming (USDA), such finance do not require a deposit, however, you will find strict money and place conditions individuals need certainly to fulfill so you’re able to be considered.

Papers criteria: Most of the people will have to give evidence of its house condition because U.S. noncitizen nationals or qualified aliens.

Conventional fund

A normal home loan are one financial this is not supported by an authorities department. Conventional funds tend to wanted large minimum credit ratings than just authorities-backed finance consequently they are often more strict in terms of acceptable debt-to-income rates, down payment wide variety and financing constraints.

Files standards: Individuals need to promote a legitimate Social Coverage count or Personal Taxpayer Character Number together with proof of the latest property position by way of a jobs consent file (EAD), environmentally friendly credit otherwise really works charge.

Non-QM finance

Non-accredited mortgages are mortgage brokers you to don’t meet up with the Individual Monetary Safeguards Bureau’s capability to pay-off laws, or specifications you to definitely loan providers feedback a beneficial borrower’s earnings and put loan terms that they’re planning repay. These types of fund are typically open to customers exactly who are unable to be eligible for old-fashioned finance, always due to bad credit, in addition they incorporate highest interest rates, high down-payment minimums, upfront fees and other will cost you qualified mortgages don’t possess. In addition they commonly include uncommon features such as the capability to make notice-only costs or balloon money.

Qualified immigration statuses: Even foreign nationals normally qualify for low-QM fund, as numerous of those loan providers none of them proof You.S. money, You.S. borrowing from the bank otherwise a social Safeguards number.

Files conditions: Your normally don’t need to provide one proof of You.S. residence status or a personal Safeguards number, and as an alternative possible just need to meet the lenders’ money, coupons and other practical standards.

3. Assemble documents

Like most homebuyer, you need to be happy to show off your income, assets, downpayment origin and you will credit rating. On the other hand, you’ll generally speaking need certainly to promote documentation of abode condition to mortgage brokers. Listed here is a listing of popular private information for https://elitecashadvance.com/payday-loans-fl/jacksonville/ during the ready:

> Public Protection count: Most government and you will antique lenders need a valid Social Cover matter so you can be considered. In some instances, one Taxpayer Identification Count was anticipate, however, basically Social Defense numbers is popular.

> Residency: Loan providers want to see good, unexpired evidence of your current residency status during the U.S. This means lawful permanent people should bring the eco-friendly cards and nonpermanent citizens should let you know their charge or a position agreement document.

> Down payment in the You.S. dollars: Money for your deposit and closing costs must be for the You.S. cash when you look at the an excellent U.S. family savings. If the that cash to start with originated from a foreign membership, you will need to give proof the exchange to You.S. bucks. Lenders like to find a consistent equilibrium for at least several weeks before the app.

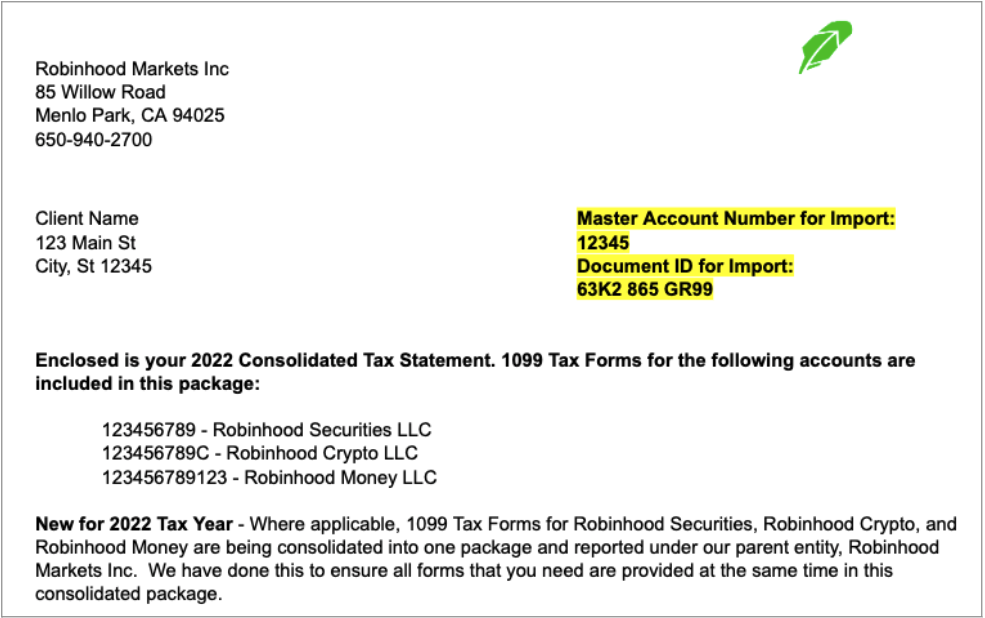

> Earnings during the U.S. dollars: Be prepared to let you know loan providers at the least going back a couple years’ earnings record, always by way of W-2s or federal tax statements, and you may establish most recent work. Any money otherwise income obtained out-of a different firm otherwise a beneficial overseas bodies into the a special money should be interpreted to cash.

> Credit score: Loan providers usually check your U.S. credit history and you can credit report from one or even more of your own around three national credit reporting agencies: Experian, Equifax and you may TransUnion. In the event the borrowing is simply too the new because of deficiencies in enough You.S. credit history, your home loan company are able to use credit recommendations from a foreign nation, provided they meet the exact same criteria to have home-based profile and generally are capable of being translated on the English. Lenders may also undertake a good nontraditional credit history, such as the past 12 months’ rent or power costs.