If you are searching to purchase a created domestic, you happen to be curious what forms of financing will help build your dream out of homeownership a real possibility.

The Federal Houses Administration’s (FHA) home loans is an easily affordable selection for those with challenging economic histories. They are able to give somebody the fresh new promise and you may method for introduce root because of their family members. Visitors may be worth a home they love, and you may FHA financing can help you during the getting you to definitely goal.

What’s an FHA Are designed Mortgage?

The newest FHA is a division of your Service of Casing and you will Urban Advancement (HUD). Its an agency that ensures mortgage loans one to accepted lenders situation. These funds help to make homeownership sensible by providing low down money and you can recognizing lower credit ratings than many other solutions. This type of mortgage wil attract so you’re able to lower-money some body and very first-time homeowners.

You can get an enthusiastic FHA mortgage to possess are manufactured home with a HUD Degree Term that adheres to certain rules established by the Are made Home Build and you can Protection Conditions (MHCSS).

How can you Rating an enthusiastic FHA Mortgage to have a produced Household?

FHA are produced lenders are particularly just like FHA financing having old-fashioned residential property. All things considered, you’ll find special FHA property and structure criteria for finding the brand new financing, in addition to needing to see lowest home loan requirements.

Minimal Mortgage Conditions having FHA Money

You really need to meet particular prerequisites away from FHA for home loan qualifications. Listed here are the minimum conditions when it comes to form of FHA financial:

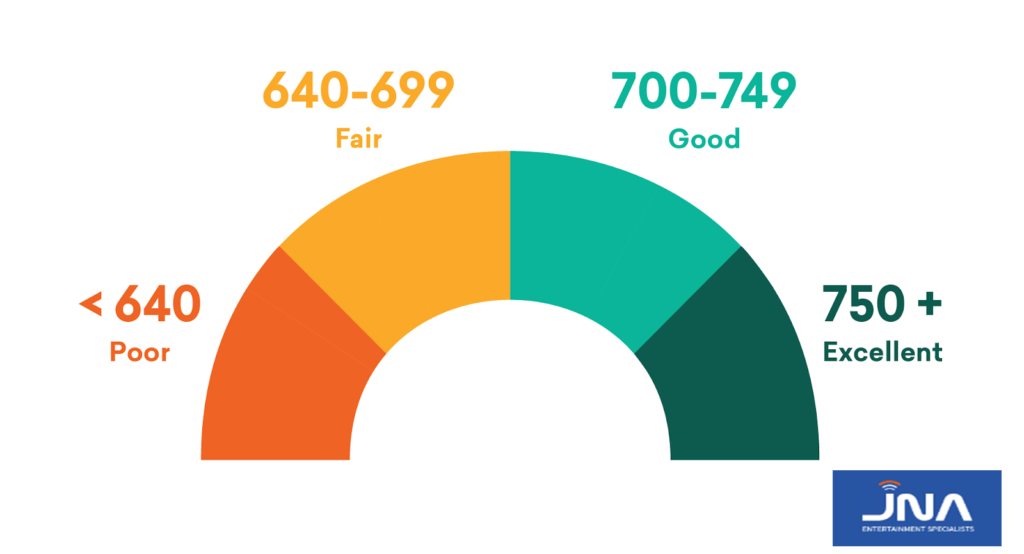

- Credit score: While FHA money are perfect for individuals as opposed to the greatest borrowing background, there are guidelines for how the score impacts the off payment. Those with an excellent FICO score off 580 or more score a step 3.5% advance payment system.

- Debt-to-money proportion: Your debt-to-earnings proportion should be less than 43%.

- Financial cost: FHA need you to definitely features a mortgage top (MIP).

- Evidence of money: Due to the fact a purchaser, you desire one another a steady stream of income and to feel in a position to confirm their employment.

- First residence: Your house should be the buyer’s number 1 household so you can qualify having FHA funds.

Property Requirements to own FHA Are built Lenders

With respect to FHA are created home guidelines, there are numerous requirements the property you want towards to buy must fulfill in order to be qualified to receive the loan.

- There has to be the means to access sewer and you will h2o business.

- The home need classify just like the https://paydayloancolorado.net/oak-creek/ home.

- You should eradicate pulling hitches and you can running tools.

- An approved HUD close have to be noticeable on the house’s additional.

Structure Criteria to have FHA Are available Home loans

You will find special FHA were created family conditions for brand new structure. If you intend to your to buy this type of house with homes, you can tend to mix the costs that have people transport expenses to have the loan amount. Yet not, there are some conditions out of this type of finance and you can framework, including:

Pros and cons off FHA Loans

If an FHA financing is right for you relies on your novel financial predicament. You can find one another advantages and disadvantages to that sorts of family financing.

Selection to FHA Are manufactured Mortgage brokers

For anybody who qualifies for 100% money otherwise has actually an exceptionally highest credit score, there are more are created home loan selection that you may possibly require to consider.

Would you Score an enthusiastic FHA Mortgage to own a modular Family?

Yes! FHA standard family conditions are particularly exactly like that from are created land. Modular belongings need to be oriented just after June 15, 1976, to help you meet the requirements. The house will need to fulfill the Design Are created Household Set up Conditions and get permanently attached to the lot. It is going to should have best liquids and you may sewage possibilities.

Finding Making an application for a manufactured Mortgage?

At the CIS Mortgage brokers, we all know the worth of providing some one down the highway out of the new Western fantasy as a result of affordable homeownership.

Our very own experienced team makes it possible to using our very own easy application process to get the loan solution that is true to you personally along with your home. All loans is susceptible to accepted credit.